All You Need to Know About Section 174 and Its Implications 🤯

Hey there, fellow knowledge seeker! 🌟 Are you curious about Section 174 and what it entails? Well, you’re in the right place! Let’s dive into the nitty-gritty of this topic and understand its significance in a fun and engaging way. 💡

What is Section 174? 🤔

Section 174 is a term that pops up in various contexts, including legal and tax jargon. Let’s break it down for you in the simplest terms. 📝

Section 174 in the Indian Penal Code 📜

If you’ve stumbled upon Section 174 in a legal context, it’s likely referring to the Indian Penal Code (IPC). This section deals with “Non-attendance in obedience to an order from public servant.” Basically, it means that if someone is legally bound to appear before a public servant (like in court) and intentionally avoids showing up, they can be penalized. 🚨

Here’s a quick breakdown:

- If you fail to attend as required by a public servant, you could face simple imprisonment for up to one month or a fine of up to five hundred rupees, or both. 💸

- If it pertains to a court order, the penalties can be more severe—up to six months in prison or a fine of one thousand rupees, or both. ⚖️

Want more details? Check out the official IPC document for all the legalese! 📑

Section 174 in the U.S. Tax Code 💰

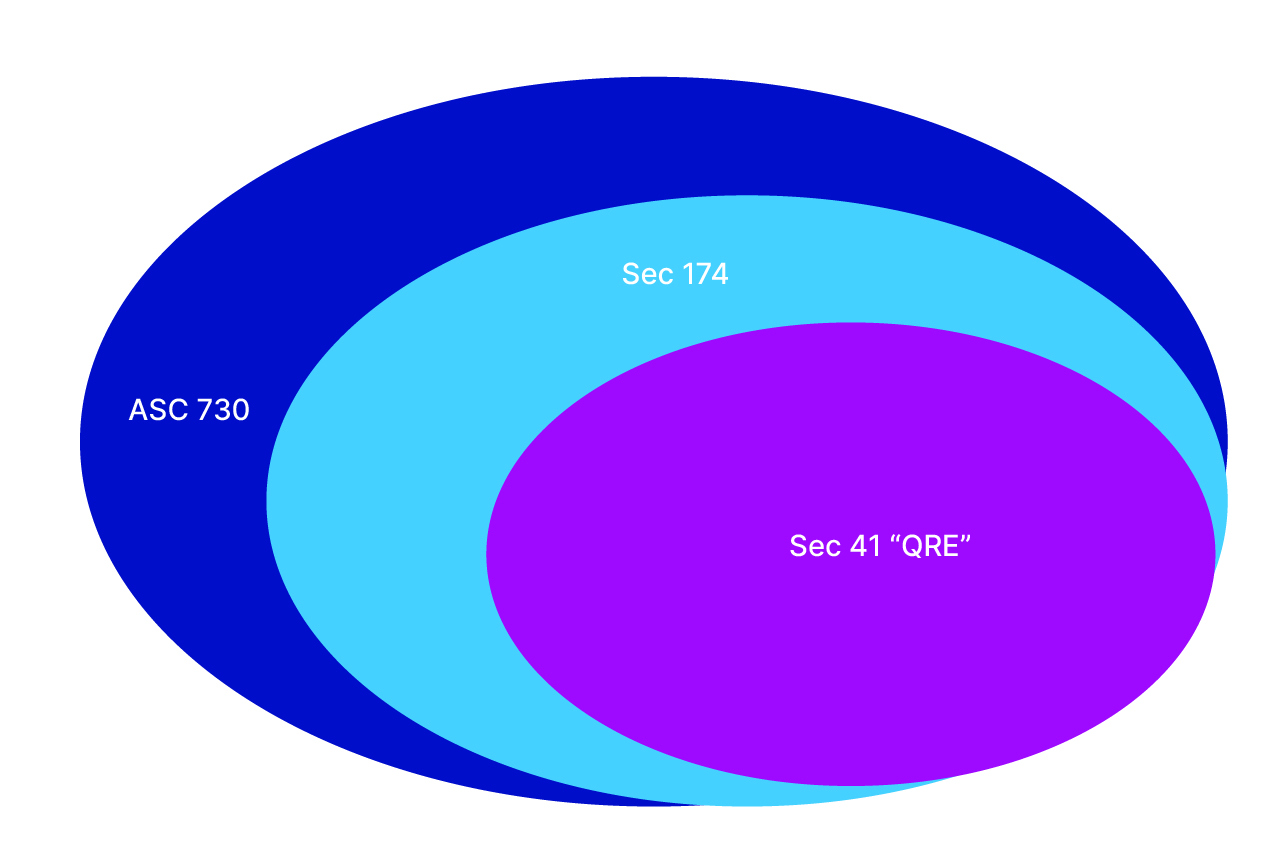

In the United States, Section 174 takes on a whole different meaning. Here, it’s all about Research & Development (R&D) expenditures. 💡

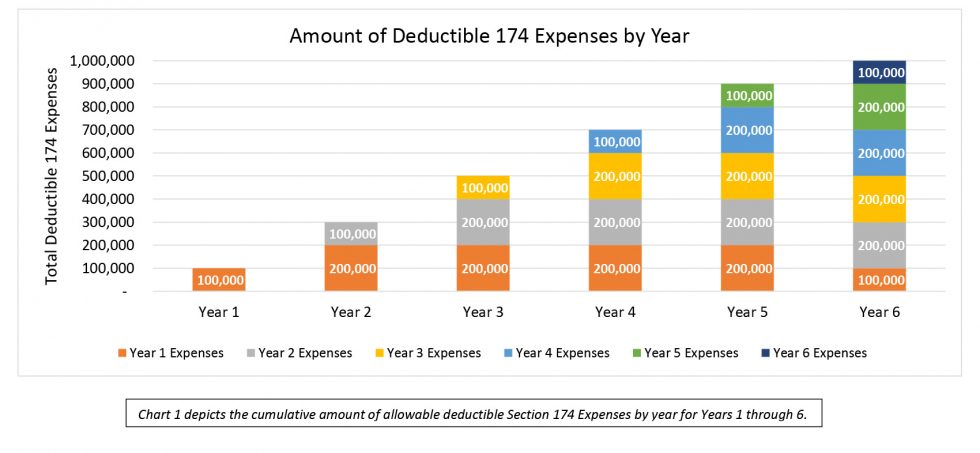

Under the Tax Cuts and Jobs Act (TCJA) of 2017, this section requires businesses to capitalize and amortize R&D expenditures instead of deducting them in a single year. 📆

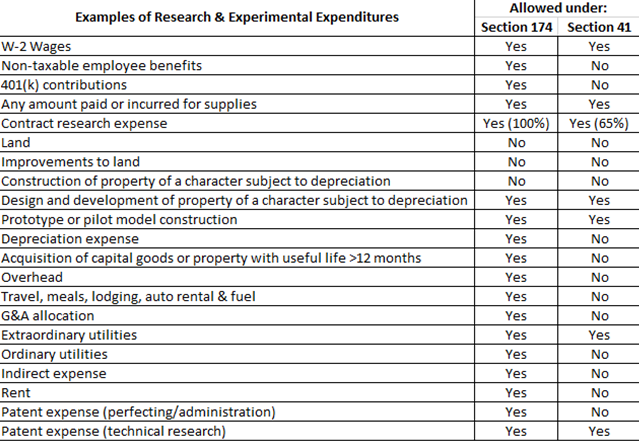

Here are some key points:

- R&D costs must be amortized over five years for U.S.-based companies and 15 years for international companies. 🌍

- The definition of R&D is broad, making it a bit tricky to determine which expenses qualify. 🧪

- This section has significant implications for companies in tech and software development, leading to increased taxable income due to longer capitalization periods. 🖥️

For a deeper dive into how this works, check out this detailed article by Thomson Reuters. 📚

Why Should You Care? 🤓

Understanding Section 174 is crucial for businesses and individuals connected to legal or corporate tax fields. Whether you’re dodging court dates 🏛️ or managing R&D budgets 📊, knowing the intricacies of Section 174 can save you time, money, and legal troubles!

Exclusions and Special Cases 🌟

Not all R&D expenditures qualify for Section 174 benefits. Here are some exclusions:

- Market research, advertising, and sales promotions. 📉

- Quality-control testing. 🔬

- Research after commercial production has started. 🏭

- Research funded by another party where the taxpayer does not retain substantial rights. 💼

The Bottom Line 🏁

So, there you have it! A comprehensive yet fun guide to Section 174 in both legal and tax contexts. Now that you’re armed with this knowledge, you can navigate these waters like a pro! 🚀

Got more questions or insights? Drop them in the comments below! We love hearing from you. 💬

Mason Caldwell is a financial expert and writer who specializes in topics related to taxation, personal finance, and economic analysis. With extensive experience in the financial industry, Mason has contributed to numerous financial publications, sharing insights that help individuals and businesses make smarter financial decisions. Known for his ability to simplify complex financial topics, Mason’s articles are both informative and accessible to a wide audience. When he’s not writing, Mason enjoys hiking, reading historical novels, and exploring new technologies in finance.