Curious About Land Tax Threshold in NSW? We’ve Got You Covered!

Hey there, property enthusiasts! If you’re diving into the realm of land ownership or investment in New South Wales, you’ve probably stumbled upon the term “land tax threshold in NSW.” Let’s break it down in an easy-to-understand, Onedio style!

What is the Land Tax Threshold in NSW?

The land tax threshold is the minimum land value at which land tax begins to apply. Simply put, if the combined unimproved value of your land holdings exceeds this threshold, you’re liable to pay land tax. But don’t worry if your property stays under this value; you won’t owe any land tax!

Latest Threshold Values for 2024-2025

Exciting updates ahead! For the 2025 and subsequent land tax years, the NSW budget has frozen the land tax thresholds at the 2024 levels. Here’s what you need to know:

- General threshold: $1,075,000

- Premium threshold: $6,571,000

Pretty straightforward, right? If your land’s value surpasses these limits, you’ll be paying land tax accordingly.

How is Land Tax Calculated?

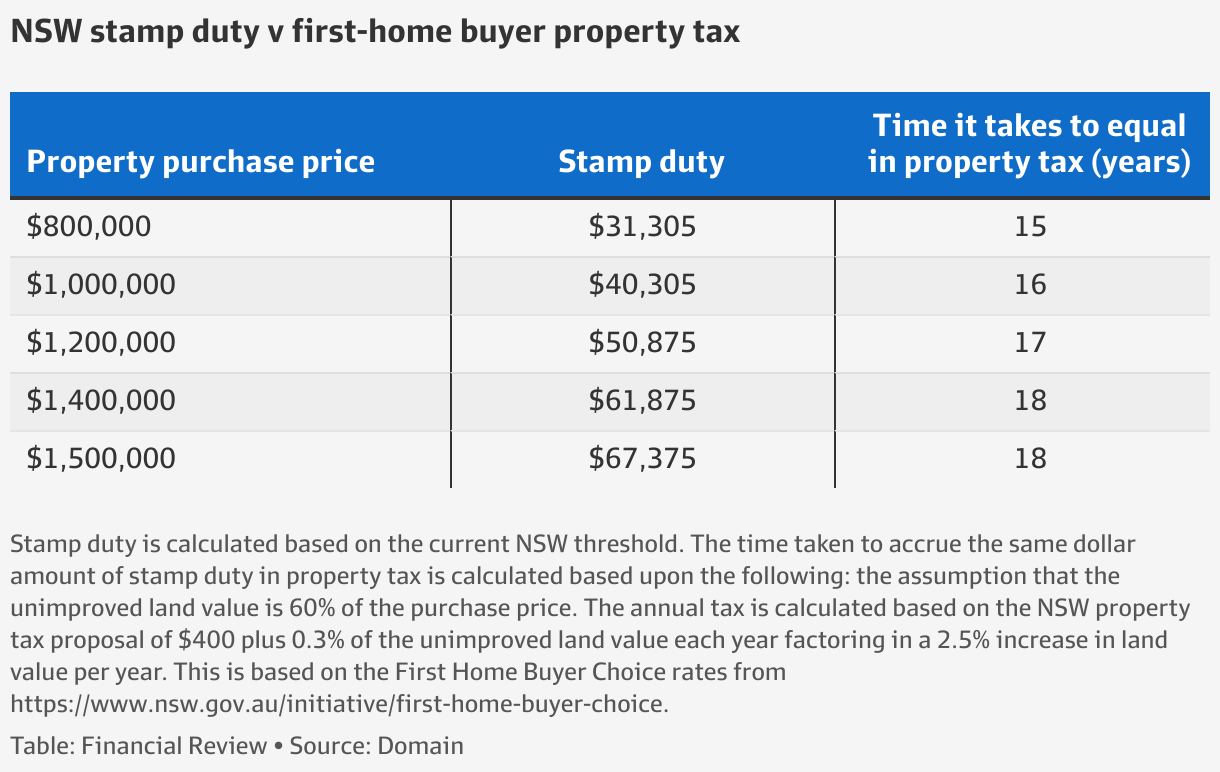

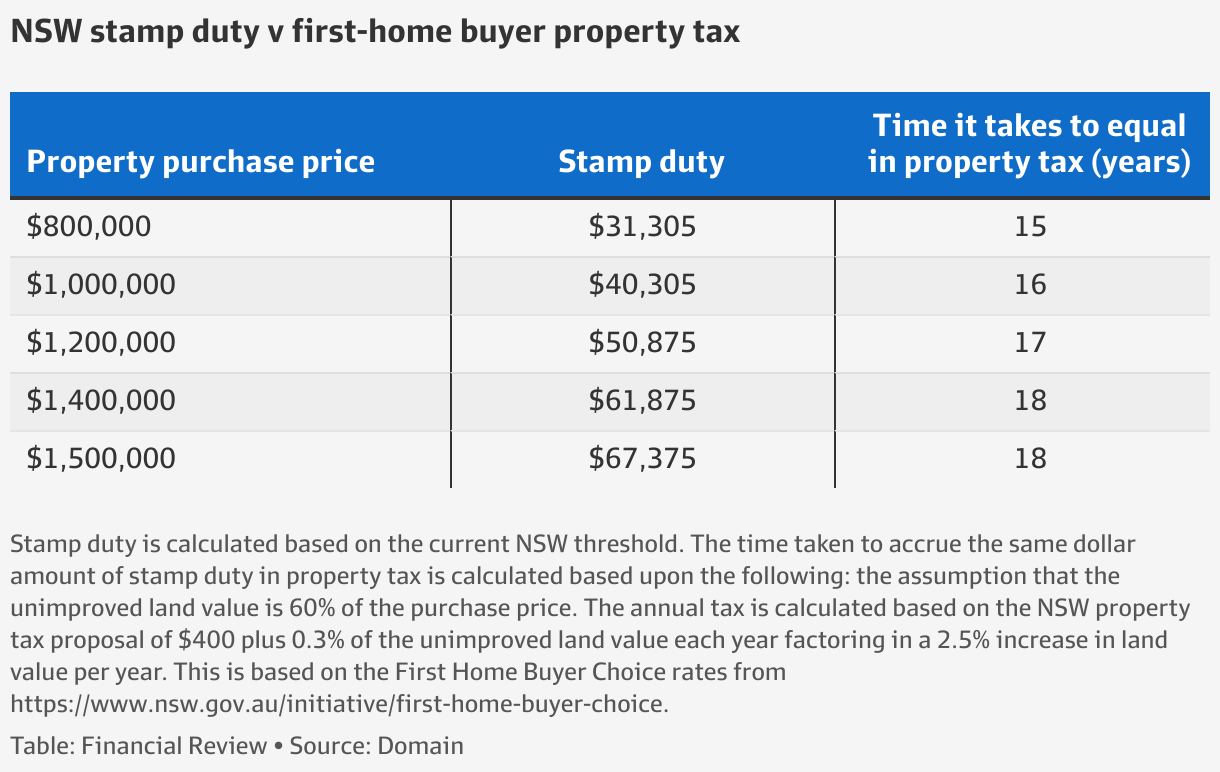

It’s all about the numbers! Land tax is calculated based on the total value of all your taxable land above the land tax threshold. Here’s the math:

- General rate: $100 + 1.6% of land value above the threshold, up to the premium threshold.

- Premium rate: $88,036 + 2% of land value above the threshold.

Remember, the tax is calculated on the value of land as at 31 December of the previous year, so any changes this year will impact next year’s tax.

Exemptions and Who Pays?

Feeling concerned about exemptions? Here’s some good news: your principal place of residence (your home) is generally exempt. Also, if you own farmland, this might qualify for primary production land exemption.

Who needs to pay land tax? You may have to if you own:

- Vacant land, including rural land

- A holiday home

- Commercial properties, investment properties, or company title units

What If Your Details Change?

Keep an eye on your details! It’s super important to notify any changes in your property or personal details promptly to avoid any hitches. This could be a change in your mailing address, land usage, or even your exemption eligibility status.

Steps to Register for Land Tax

If you own land above the threshold, you must register for land tax. Yes, it’s a requirement! Head over to the official Revenue NSW page and get yourself registered to stay compliant.

Objections and Reviews

Got an issue? If you think there’s been a mistake, you can lodge an objection within 60 days of the assessment or decision. However, ensure you pay any due amount on time as interest will be imposed on overdue amounts.

Final Thoughts

Understanding the land tax threshold in NSW is crucial for any current or future landowner. By keeping informed and staying on top of your obligations, you can manage your property investments with confidence.

Got more questions? Drop them in the comments and let’s chat! Happy investing!

Mason Caldwell is a financial expert and writer who specializes in topics related to taxation, personal finance, and economic analysis. With extensive experience in the financial industry, Mason has contributed to numerous financial publications, sharing insights that help individuals and businesses make smarter financial decisions. Known for his ability to simplify complex financial topics, Mason’s articles are both informative and accessible to a wide audience. When he’s not writing, Mason enjoys hiking, reading historical novels, and exploring new technologies in finance.

Have you been…

Have you been…

Ever…

Ever…

If you’ve been searching about…

If you’ve been searching about…