How to Become a Commercial Tax Officer: A Step-by-Step Guide

Hey there! If you’ve stumbled upon this article, you’re probably curious about how to become a Commercial Tax Officer. Guess what? You’ve landed in the right place! This guide will take you through everything you need to know about this exciting career. So, let’s jump right in!

What is a Commercial Tax Officer?

First things first, let’s get to know the role. A Commercial Tax Officer (CTO) is a government official responsible for the assessment, collection, and administration of commercial taxes. These taxes are vital for the state’s revenue, and a CTO ensures that businesses comply with tax laws and regulations. Sounds challenging, right?

Roles and Responsibilities

Here’s a quick rundown of what you’ll be doing as a CTO:

- Tax Assessment: Scrutinizing the financial affairs of businesses to ensure they are accurately reporting their income.

- Compliance: Enforcing tax laws and regulations to prevent tax evasion.

- Audits: Conducting audits to verify the accuracy of tax filings.

- Advisory: Advising businesses on how to comply with tax regulations.

- Dispute Resolution: Handling disputes and complaints related to commercial taxes.

Steps to Become a Commercial Tax Officer

So, you’re intrigued and ready to take the plunge? Awesome! Here’s a step-by-step guide to get you there:

1. Educational Qualification

First up, you’ll need a bachelor’s degree. While the field of study isn’t strictly defined, degrees in commerce, economics, law, or accounting are super beneficial. This educational foundation provides the necessary knowledge in finance, taxation, and law.

2. Clearing Competitive Exams

Once you’ve got your degree, the next hurdle is clearing state-level competitive exams conducted by the State Public Service Commission. These exams test your understanding of commercial laws, general knowledge, and analytical skills. It’s a tough nut to crack, but with dedication, you can do it!

3. Specialized Training

After clearing the exams, it’s training time! You’ll undergo rigorous training that focuses on state-specific tax laws, auditing, accounting, and administrative skills. This will equip you with the practical knowledge and skills needed for the job.

4. Appointment

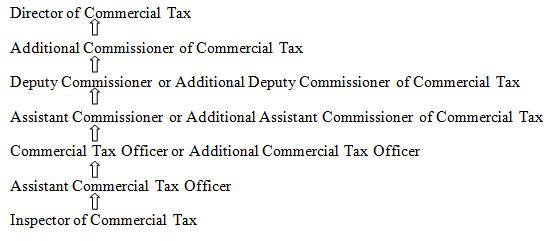

And finally, after all that hard work, you’ll be appointed as a Commercial Tax Officer. Now you’re ready to dive into your role, enforcing tax laws and ensuring compliance to keep the state’s revenue flowing smoothly.

Skills Required

Wondering if you have what it takes? Here are some key skills you should have:

- Analytical Skills: To interpret complex tax laws and analyze financial documents.

- Attention to Detail: Precision is crucial when examining tax returns and financial statements.

- Communication Skills: Explaining complex tax laws to taxpayers requires clear and effective communication.

- Integrity: High ethical standards are non-negotiable in this role.

- Adaptability: Tax laws evolve constantly, so staying updated is crucial.

Conclusion

Becoming a Commercial Tax Officer is a journey of dedication, learning, and growth. From obtaining a degree to cracking competitive exams and undergoing specialized training, the path is challenging but rewarding. With the right skills and determination, you can uphold the law and contribute significantly to the state’s revenue.

So, are you ready to embark on this exciting career? Start your journey today and make a difference!

Mason Caldwell is a financial expert and writer who specializes in topics related to taxation, personal finance, and economic analysis. With extensive experience in the financial industry, Mason has contributed to numerous financial publications, sharing insights that help individuals and businesses make smarter financial decisions. Known for his ability to simplify complex financial topics, Mason’s articles are both informative and accessible to a wide audience. When he’s not writing, Mason enjoys hiking, reading historical novels, and exploring new technologies in finance.

Ready to dive into the thrilling…

Ready to dive into the thrilling…

If you’ve been searching about…

If you’ve been searching about…