Tax Amount for Second Job: What You Need to Know!

Hey there!

Why Work a Second Job?

First things first, why might you be considering a second job? There are many reasons!

No matter your reason, it’s crucial to understand the tax implications.

Understanding Your Tax Code

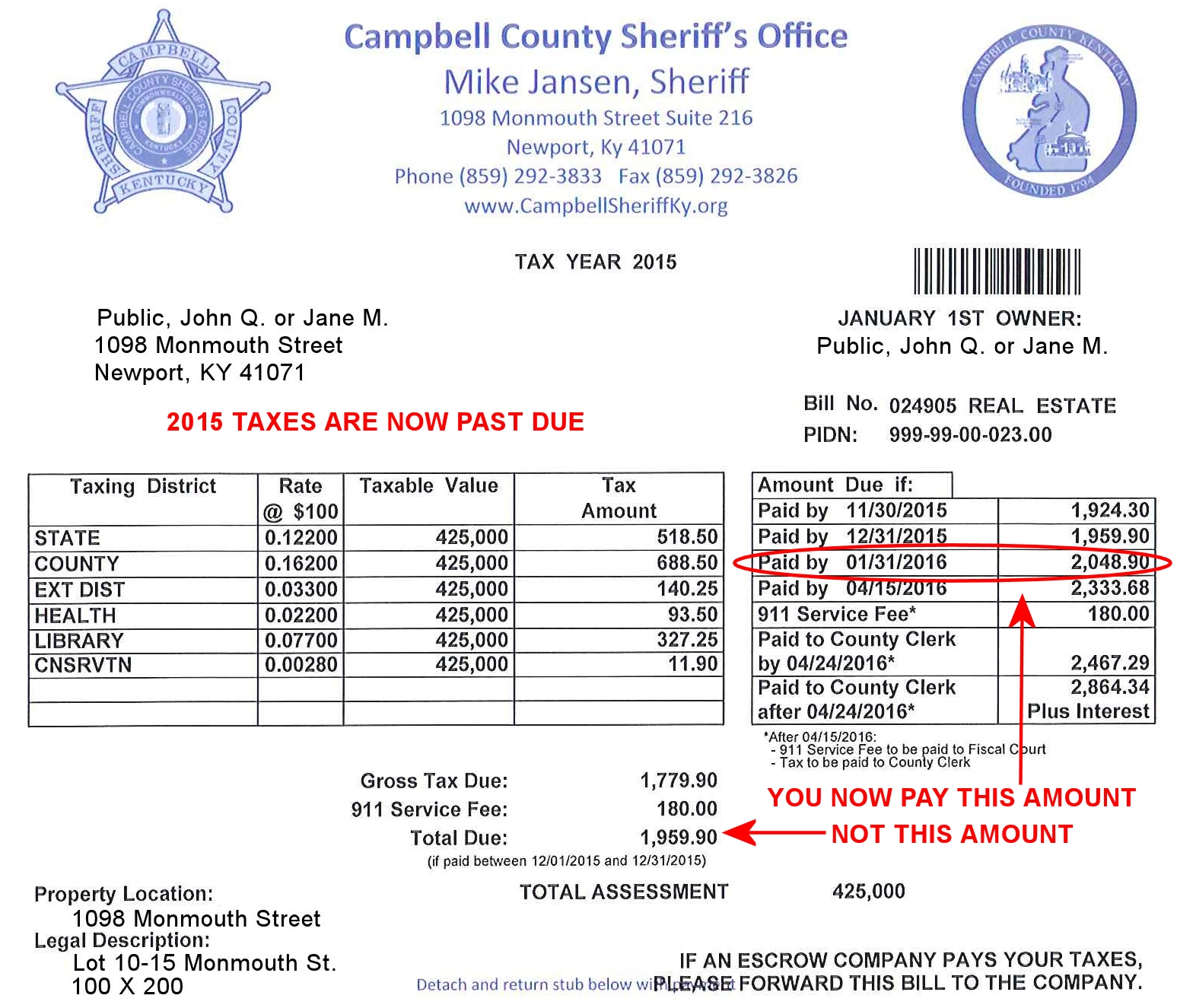

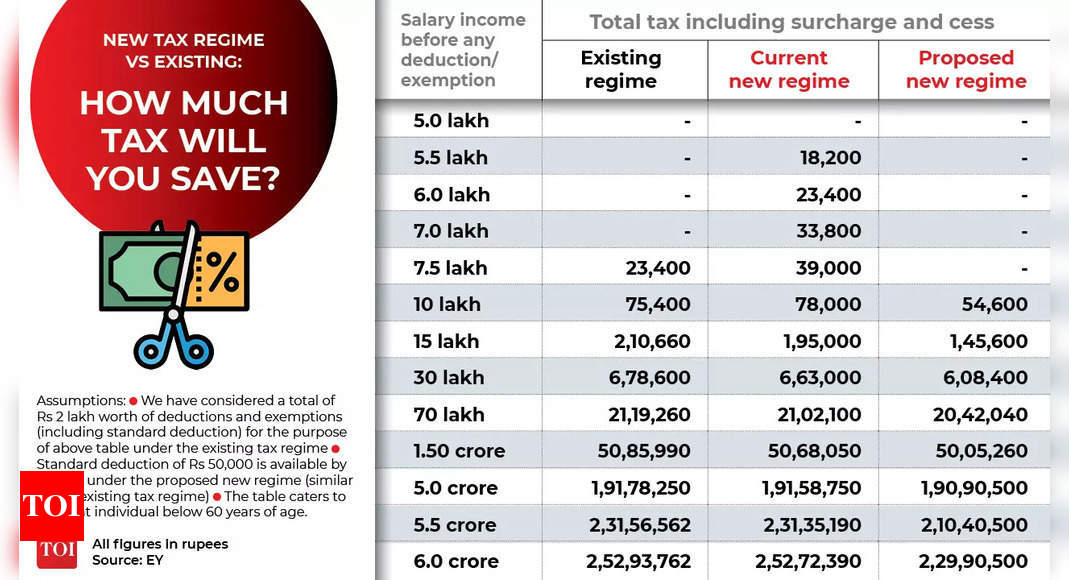

In the UK, everyone has a tax-free personal allowance – the amount you can earn before paying tax. Your main job usually uses up most or all of this allowance, meaning your second job will likely be taxed at the basic rate of 20% (or higher if you earn more).

How Is Tax Calculated on a Second Job?

Here’s where it gets a little technical!

Double Jobbing: Do I Need to Tell HMRC?

Yes, absolutely! You need to inform HMRC about your second job to ensure you’re paying the right amount of tax. Even if you’re paid in cash, it’s your responsibility to report the extra income.

Common Questions About Tax on Second Jobs

1. Will I Pay Higher Taxes?

Potentially! If your second job income pushes you into a higher tax bracket, you could end up paying more tax overall. However, if your total income stays within the basic rate, you’ll continue to pay 20% on your second job earnings.

2. Can I Claim Expenses?

Yes, if your second job incurs expenses, you might be able to claim tax relief on those. Keep track of any work-related expenditures!

3. What About National Insurance?

National Insurance (NI) contributions will also be due on your second job. Like tax, NI is calculated separately for each job based on your earnings.

Best Practices for Managing Your Taxes

To make sure you’re not caught off guard at the end of the tax year, consider these tips:

Wrapping Up

Working a second job can be a fantastic way to increase your income, but it does come with additional tax responsibilities. By understanding how tax on a second job works and staying organized, you can avoid any nasty surprises. Got more questions? Drop them in the comments below or chat with a tax expert!

Happy double jobbing!

Mason Caldwell is a financial expert and writer who specializes in topics related to taxation, personal finance, and economic analysis. With extensive experience in the financial industry, Mason has contributed to numerous financial publications, sharing insights that help individuals and businesses make smarter financial decisions. Known for his ability to simplify complex financial topics, Mason’s articles are both informative and accessible to a wide audience. When he’s not writing, Mason enjoys hiking, reading historical novels, and exploring new technologies in finance.

If you’re curious…

If you’re curious…

If you’ve been…

If you’ve been…