2024 Standard Deduction: What You Need to Know!

Hey there, tax enthusiasts and savvy savers! 🎉 The 2024 tax season is just around the corner, and you might be wondering what changes are coming your way. Well, look no further! We’ve got all the juicy details on the 2024 standard deduction right here for you. Let’s dive in!

What’s New with the 2024 Standard Deduction?

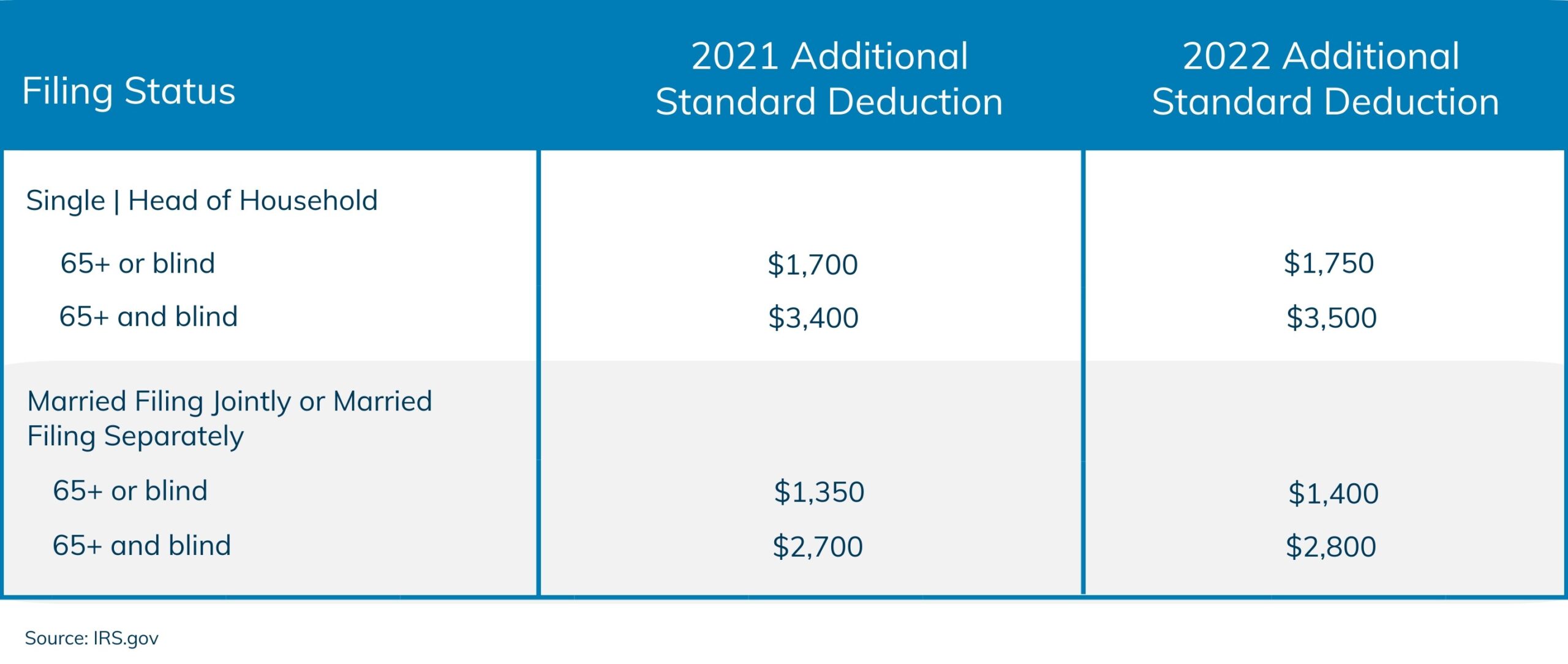

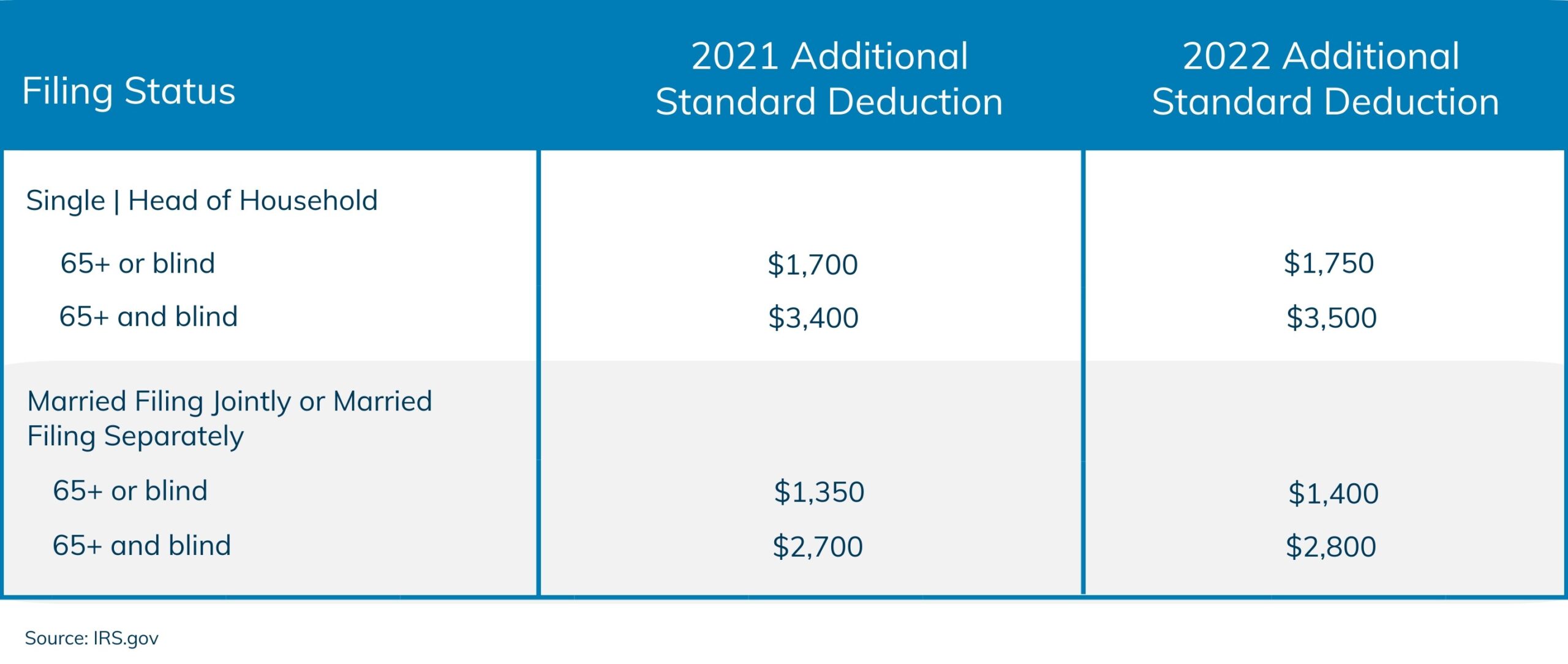

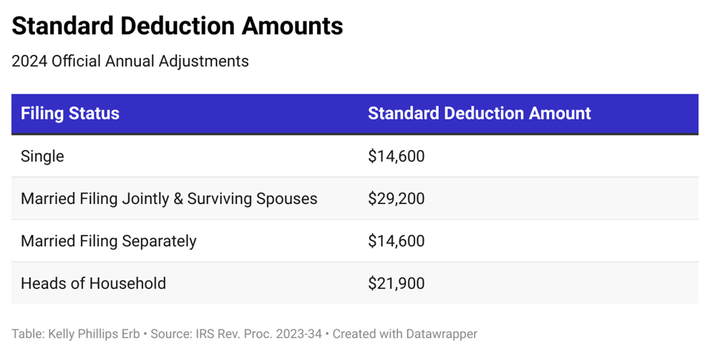

In response to inflation, the IRS has adjusted the standard deduction amounts for 2024. This is good news for many Americans, as the increase allows you to keep more of your hard-earned income. Check out the new standard deduction amounts below:

- Married Filing Jointly: $29,200 (an increase of $1,500 from 2023)

- Single Filers: $14,600 (a $750 increase from 2023)

- Heads of Household: $21,900 (an increase of $1,100 from 2023)

Why Does This Matter?

The standard deduction is a set amount by which you can reduce your taxable income. It simplifies the tax filing process and can significantly lower your tax bill. By adjusting these amounts for inflation, the IRS ensures that taxpayers are not unfairly impacted by rising costs over time.

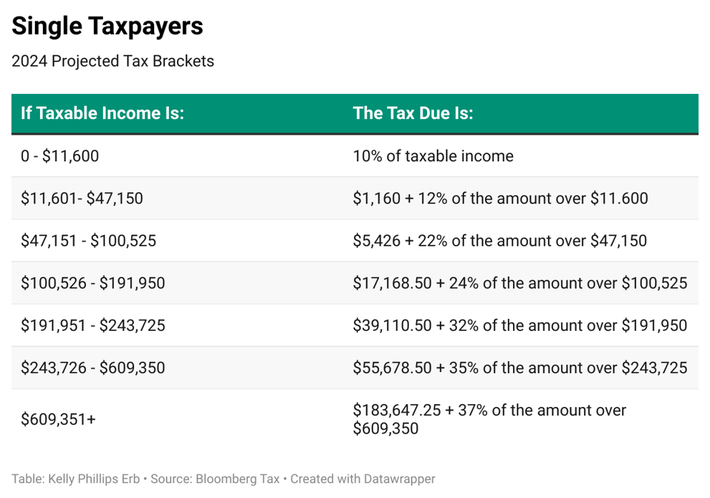

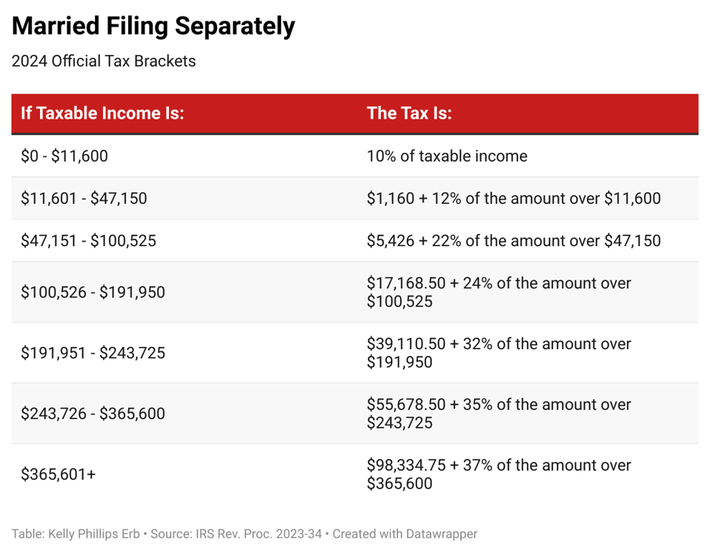

Tax Bracket Updates for 2024

Along with the standard deduction, the IRS has also adjusted the tax brackets for 2024. This means that some taxpayers may find themselves in a lower tax bracket, which could result in a smaller tax bill. For example, if you earned $46,000 in 2023, you were in the 22% tax bracket. But for 2024, you’d fall into the 12% tax bracket with the same income!

Retirement Plan Contribution Limits

Ready to save even more? In 2024, the contribution limit for 401(k) and 403(b) plans increases to $23,000 annualy (up from $22,500). For those aged 50 and over, you can contribute an additional $7,500, making it $30,500 in total!

Should You Itemize or Take the Standard Deduction?

While the standard deduction is a great option for its simplicity, some taxpayers may benefit more from itemizing their deductions. If you have significant deductible expenses, such as mortgage interest, state and local taxes, or charitable contributions, itemizing may save you more money. Check the IRS page on tax deductions for more detailed info.

Final Thoughts

The 2024 tax changes, including the new standard deduction amounts, offer a great opportunity to minimize your tax burden and maximize your savings. Make sure to consult with a tax professional to determine the best strategy for your financial situation. Happy tax planning! 💰

Stay Informed!

Keep an eye on the IRS official announcements and updates. It’s always a good idea to stay ahead of the game when it comes to your finances.

What do you think about the new changes? Share your thoughts in the comments below! 👇

Mason Caldwell is a financial expert and writer who specializes in topics related to taxation, personal finance, and economic analysis. With extensive experience in the financial industry, Mason has contributed to numerous financial publications, sharing insights that help individuals and businesses make smarter financial decisions. Known for his ability to simplify complex financial topics, Mason’s articles are both informative and accessible to a wide audience. When he’s not writing, Mason enjoys hiking, reading historical novels, and exploring new technologies in finance.