2023 Standard Deduction: Everything You Need to Know!

Hey everyone! Looking to understand the 2023 standard deduction and how it affects your taxes? You’re in the right place. We’ve broken it all down for you in the simplest, most engaging way possible. Let’s dive in!

What is the Standard Deduction?

The standard deduction is a specific dollar amount that reduces the income you’re taxed on. Essentially, it’s a tax break that lowers your taxable income. Each year, the IRS adjusts this amount to reflect inflation.

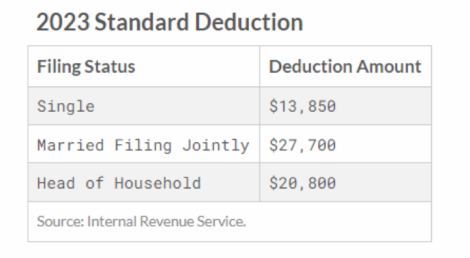

Standard Deduction Amounts for 2023

For 2023, the standard deduction amounts have increased. Here’s what you need to know:

- Married Filing Jointly or Qualifying Surviving Spouse: $27,700 (increase of $1,800)

- Head of Household: $20,800 (increase of $1,400)

- Single or Married Filing Separately: $13,850 (increase of $900)

Additional Standard Deductions for Those 65 and Older or Blind

If you’re 65 or older or blind, you get even more deductions!

- Single or Head of Household: Additional $1,850 (increase of $100)

- Married taxpayers or Qualifying Surviving Spouse: Additional $1,500 (increase of $100) per individual

Example Scenario

Let’s say you’re a married couple filing jointly with an adjusted gross income (AGI) of $125,000. With the standard deduction of $27,700, your taxable income will be reduced to $97,300. 🎉

Should You Itemize or Take the Standard Deduction?

The big question! While the standard deduction is the easier route, itemizing might save you more money if you have significant deductible expenses. Here are some common itemized deductions:

- Mortgage interest

- Medical expenses

- State and local taxes

- Charitable donations

Still unsure? Tax software or a tax pro can compare both methods for you to see which option offers the most savings.

When You Can’t Take the Standard Deduction

There are a few situations where you may not qualify for the standard deduction. For example:

- You are married filing separately, and your spouse itemizes deductions.

- You are a nonresident alien or dual-status alien during the year.

- You file a tax return for a period less than 12 months.

Get Calculating!

Curious about your own standard deduction? Check out the NerdWallet Standard Deduction Calculator to estimate your deduction for 2023.

Wrapping Up

So there you have it, folks! Understanding your standard deduction for 2023 will make your tax-filing season just a little bit easier. Be sure to take advantage of all the deductions you qualify for to keep more of your hard-earned money. Happy filing! 🥳

Do you have more questions about taxes? Let us know in the comments!

Mason Caldwell is a financial expert and writer who specializes in topics related to taxation, personal finance, and economic analysis. With extensive experience in the financial industry, Mason has contributed to numerous financial publications, sharing insights that help individuals and businesses make smarter financial decisions. Known for his ability to simplify complex financial topics, Mason’s articles are both informative and accessible to a wide audience. When he’s not writing, Mason enjoys hiking, reading historical novels, and exploring new technologies in finance.